How do tax brackets work?

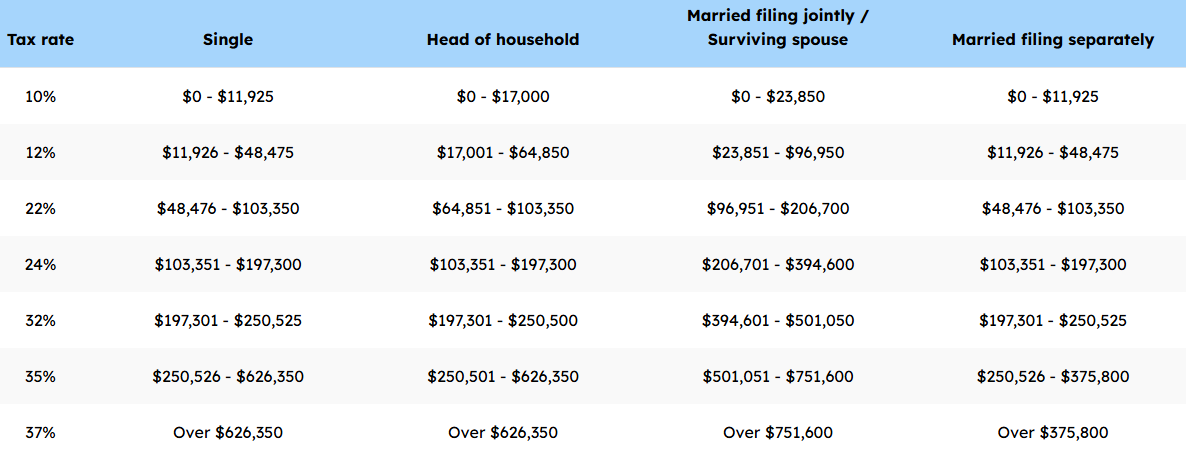

The IRS has released the following tax brackets for the 2025 Tax Year -

The United States operates under a progressive tax regime, which means different levels of your income get taxed at different rates. As an example, for a single filer with taxable income of $48,000, the first $11,925 will be taxed at 10%, while the remainder of the compensation will be taxed at 12%. Since the cap on the 12% threshold is $48,475, that will be the highest tax bracket this individual is subject to.

Familiarity with these brackets helps individuals get a reasonable understanding of their effective tax rate, which is the percentage of tax an individual ultimately pays the IRS.

Advantages of Health Savings Accounts (HSA)

HSA accounts have the unique distinction of being triple-tax advantaged. What exactly does that mean?

Pre-Tax or Tax-Deductible Contributions

HSA contributions reduce tax liability. If you contribute via payroll, those contributions are pre-tax contributions. Contributions made otherwise are tax-deductible.

Tax-Free Growth

Funds in HSA accounts can be invested, and any earnings in this account grow tax-free. This means no taxes on interest, dividends, and capital gains!

Tax-Free Withdrawals for Qualified Medical Expenses

Qualified withdrawals from these accounts are completely tax-free.

These characteristics make HSA accounts one of the best vehicles for growth and compounding.

Upcoming Tax Benefits for Young Families

Here are some tax benefits available to most young families for the 2025 tax year –

Child Tax Credit Expansion

This credit goes up by $200 and is now $2,200 per child, versus the previously permitted amount of $2,000.

Higher Dependent Care Flexible Spending Account (DCFSA) Limit

For many years, the IRS limited pre-tax DCFSA contributions to $5,000 annually. Beginning in 2026, that limit has been increased 50% to $7,500 annually. This change is for the 2026 tax year, but families can start making larger contributions beginning January 1, 2026.

Trump Account Tax Savings

While open to all U.S. citizens under age 18, the government has allowed every U.S. citizen born between January 1, 2025 through December 31, 2028 to receive a one-time $1,000 pilot program contribution. This amount, along with up to $5,000 of annual contributions, will be housed in a “Trump Account” and will grow in a tax-advantaged manner until the beneficiary turns 18, at which point the account converts to a traditional IRA. The opportunity to get a multi-decade head start on retirement accumulation cannot be overstated, and an election to enroll is available on 2025 tax returns!

Some Benefits of Filing Early

Tax season comes with its fair share of anxiety. Let’s be honest – it isn’t something we look forward to. But we can certainly take action to position ourselves well, and that begins with planning to file our tax returns earlier in the year.

How does expediting your tax filing help? Well, here are a few tangible benefits –

Faster Refund Processing

The IRS processes fewer tax returns earlier in the season. Filing early enables the IRS to process your refund quicker, which means you can plan for that vacation earlier, or simply invest the proceeds to build your nest egg.

Greater Personalization & Stress Reduction

Accountants have a lot of clients. This invariably means that we juggle multiple clients, as we get closer to the April 15 deadline. In submitting your documents early, you are in a scenario where you potentially have our undivided attention. This means faster communication and turnaround times. Once the tax return is filed, the last-minute rush and stress associated with the filing deadline is gone!

Fraud Protection

Tax-related identity theft has gone up over the years (The FBI has reported a 26% increase in tax related identity theft complaints from the previous year). In this scenario, a scammer could impersonate you and file “your” tax return with the intent to collect your refund. Filing early means that the IRS has a record of your return. If a fraudulent return is filed, it will be rejected.

Payment Planning

In the event you owe the IRS money, filing early helps with payment planning. If the amount is unexpectedly large, you may need some time to assess your finances and raise the amount due.

We look forward to working with you and making your tax-filing experience efficient and stress-free!